London's legal talent contest: the data behind US & UK firms vying for Partners

For years now, competition for London's top legal talent has been characterized by large US firms swooping into the UK market and offering significantly higher salaries than their British rivals. The ongoing US expansion has created a stiff contest for London based Partners, so we decided to dig into some of the data behind this trend.

Using

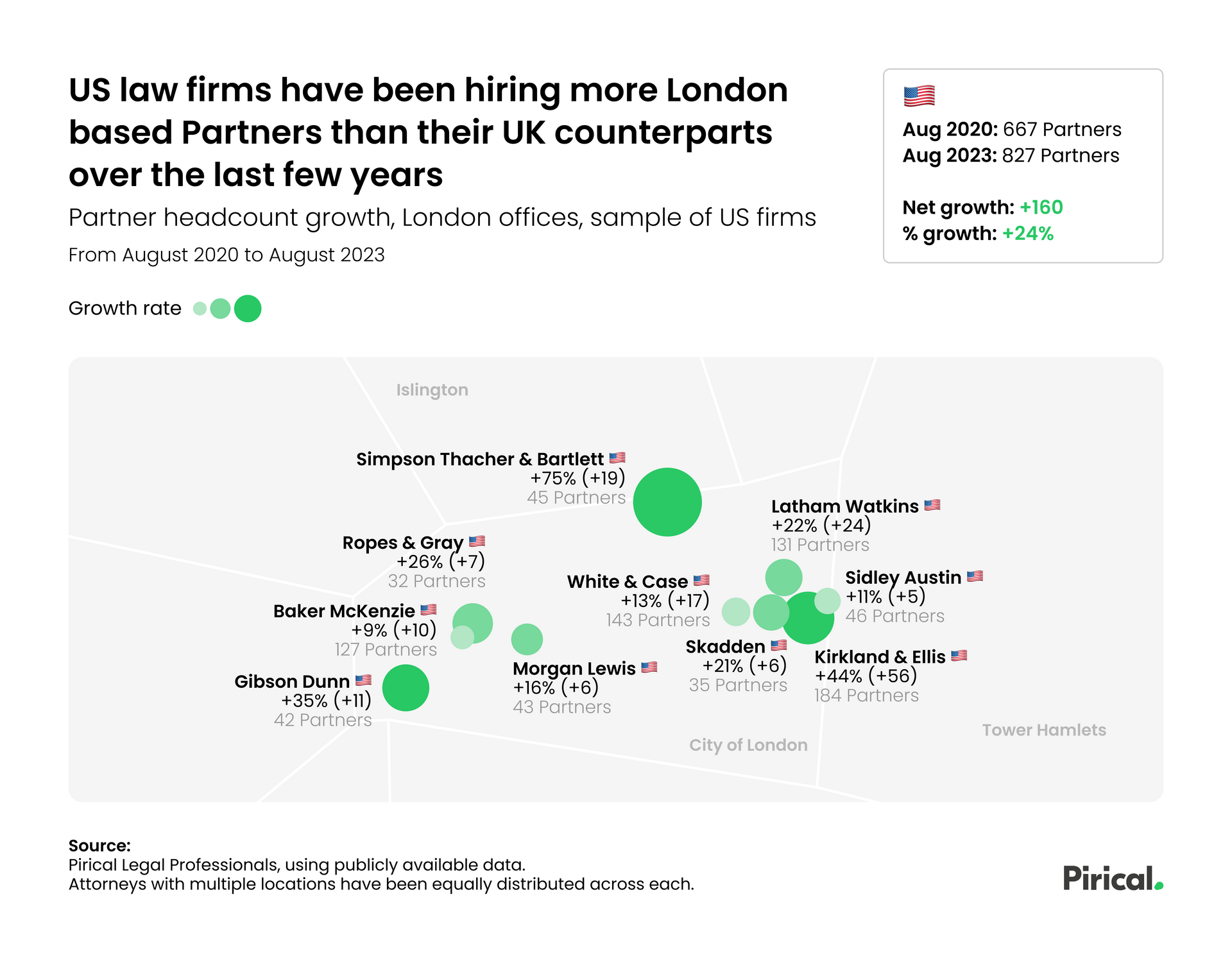

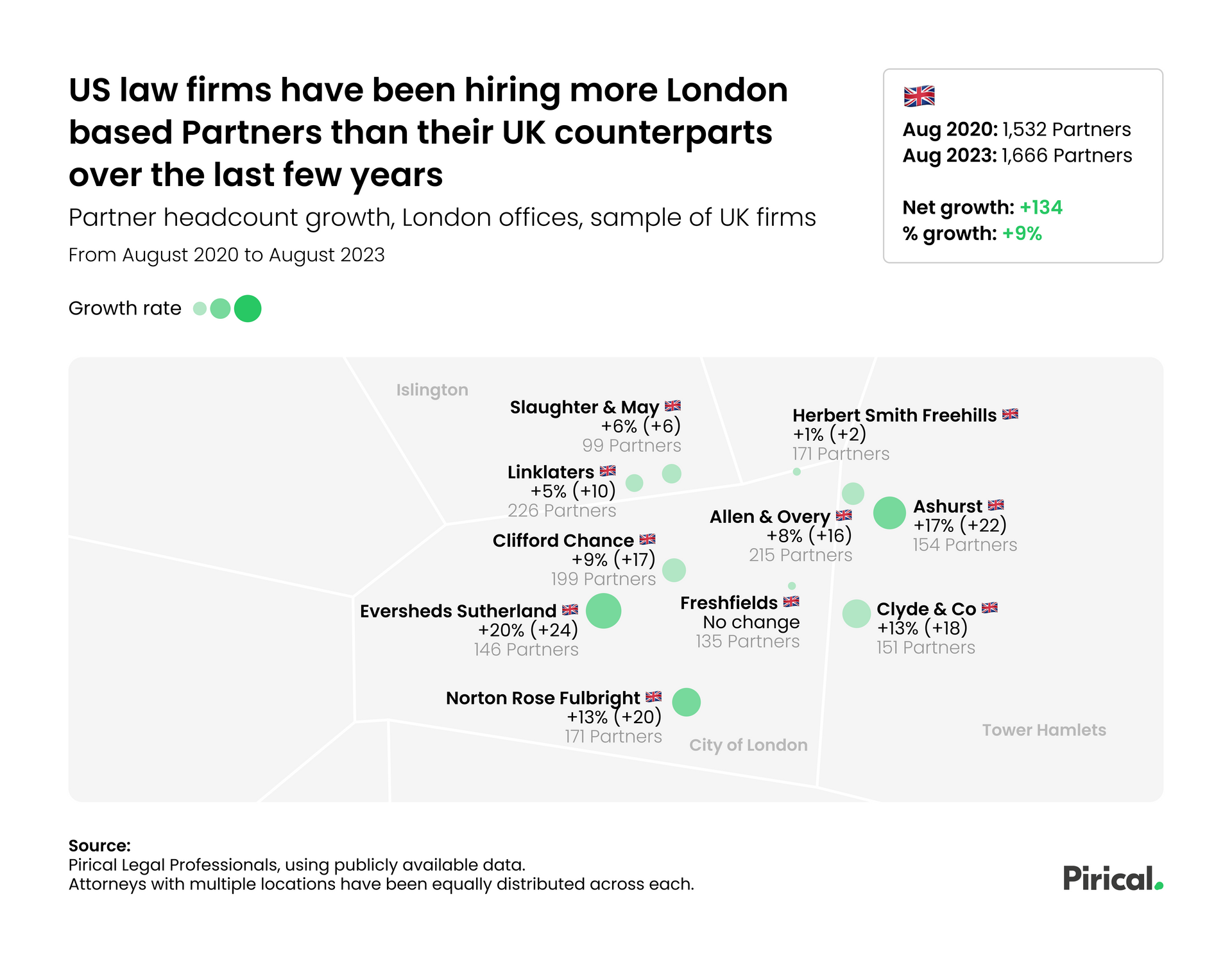

Pirical Legal Professionals we looked at Partner headcount growth over the last three years, among the London offices of a sample of US & UK law firms. Unsurprisingly perhaps, UK firms have been struggling to compete with their US peers when it comes to hiring Partners.

Based on the sample of law firms we looked at, British firms have experienced a 9% growth in their Partner headcount since August 2020. Meanwhile, the US firms have increased their London based Partner numbers by 24%, more than double the growth of their UK peers.

A handful of UK firms have seen comparable increases to their US rivals, with Eversheds Sutherland (+17%) and Ashurst (+22%) increasing their Partner numbers at a similar rate to Skadden (+21%) and Latham Watkins (+22%). However, these firms fall well short of the largest US growers such as Gibson Dunn (+35%), Kirkland & Ellis (+44%), and Simpson Thacher & Barlett (+75%).

The large US law firms are likely to continue their push into the London market and given the gulf in salaries being offered, this trend of US firms dominating Partner hires is also set to continue.

Interestingly, when looking at where these Partner hires are being sourced from, it's not a case of the US firms simply poaching the top talent of the UK firms.

From a similar time frame, the data shows that the US firms used in this analysis made their Partners hires from both UK & US firms. Magic Circle firms represent a significant source of the moves, but the majority of Partner hires are being taken from other London based US firms.

Interested in legal market insights?

Understand the legal market better with Pirical Legal Professionals, the leading global database of over 560,000 attorneys. Make decisions based on data with our comprehensive market coverage; monitor which law firms are thriving and which are churning, track attorney movements, and identify trends within the legal industry.

Subscribe to the latest data insights & blog updates

Fresh, original content for Law Firms and Legal Recruiters interested in data, diversity & inclusion, legal market insights, recruitment, and legal practice management.