Who Made the Cut? A Look at 2024's AM Law Partner Promotions so Far

As we near the end of the year, there have been a flurry of Partner promotion announcements from the top AM Law firms. Overall, promotion class sizes have decreased for the second year in a row. But is this a dramatic shift or an expected pivot in strategy?

Using publicly-available data from Pirical Legal Professionals (PLP), we've looked into a few of the trends among the promoted Partners from 2024 so far and how the promotion classes compare to previous years.

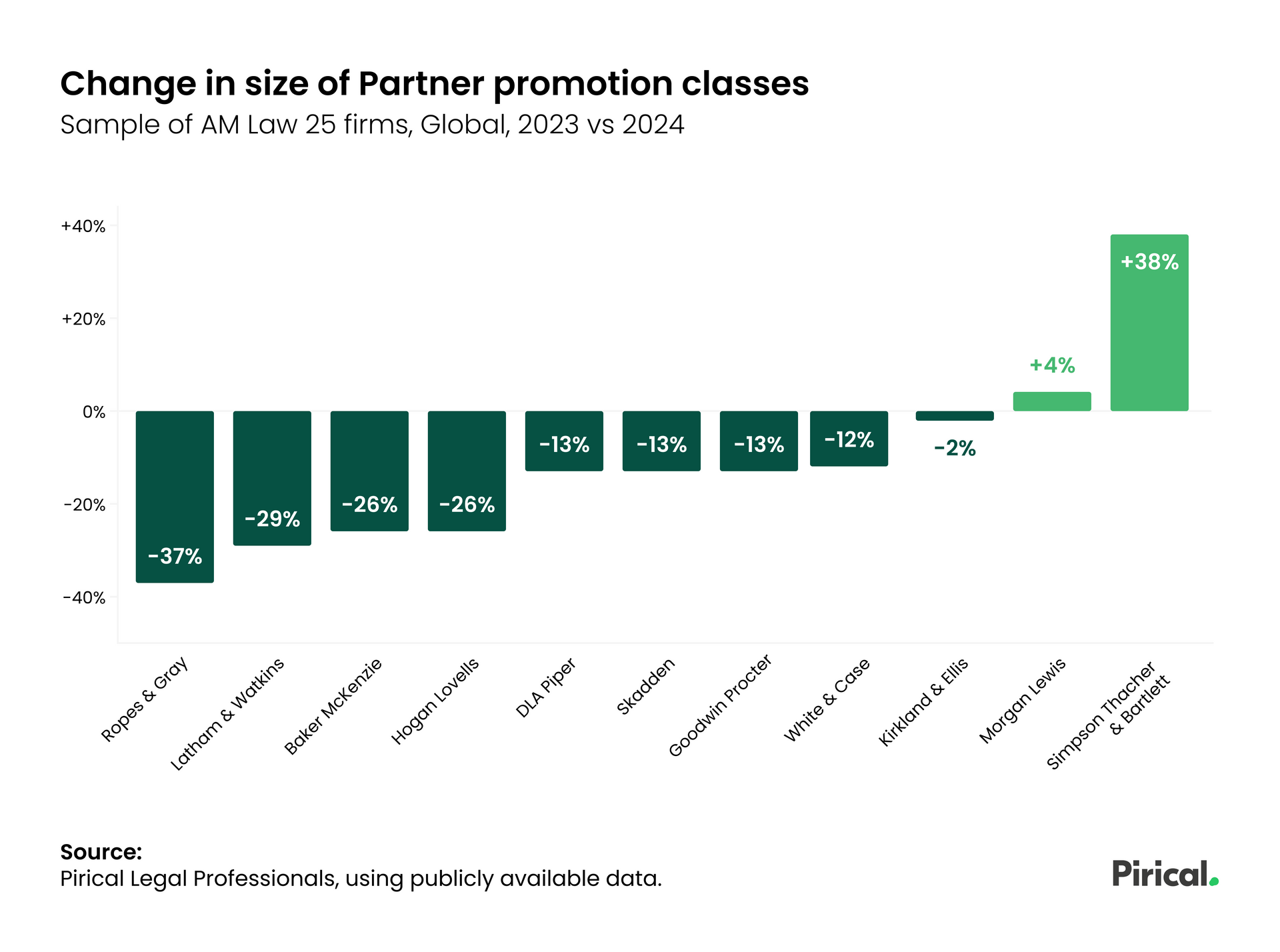

Across most of the top AM Law firms, Partner promotion class sizes have decreased from 2023

After a record number of promotions in 2023, Kirkland & Ellis promoted fewer Partners than the previous year, as have most of the AM Law 1-25 firms that have already announced their promotion classes for 2024.

There's a similar trend among the top UK law firms as well

Eversheds Sutherland and A&O Shearman are the only top 10 UK firms to have promoted more Partners in 2024 than 2023. A&O Shearman's Partner class partly grew thanks to the combination of Allen & Overy (32) and Shearman Sterling (8) Associates.

However, the decreasing volume of Partner promotions is a return to more normal levels after a peak in 2022

The number of promoted Partners increased dramatically in 2022 and remained high in 2023. This year's combined numbers are still higher than the 2020 or 2021 class sizes.

This year's decrease in BigLaw promotions has occurred across most practice areas, but Corporate numbers have grown

The share of promoted Partners that work in Corporate practices has increased by +6% compared to 2023, while most other practice areas have decreased by a small amount.

The focus on Corporate practices is primarily driven by attorneys working in M&A and Investment Funds

M&A demand has been growing steadily this year and 'activity is only expected to keep climbing because of the needs and desires of corporate leaders to transform their businesses — due primarily to the impact of AI and to accelerate their growth in a sluggish economy.'

Litigation and Banking & Finance also remain popular practice areas among this year's promoted Partners.

The promoted Partners are a mixture of homegrown talent and lateral hires

Some are homegrown talent who have spent the majority of their career at their current firm, while others have been laterally hired by their current firm after spending a few years working at a rival law firm. The top AM Law firms have all deployed slightly different strategies to acquiring and developing their Associates.

The level of experience among 2024's promoted Partners varies

The broad range of experience could relate to the mixture of equity and non-equity Partner tiers.

Kirkland & Ellis continue to remain an outlier in promoting more junior attorneys to their Partnership

Of the 200 Partners promoted by Kirkland & Ellis this year, most have 6-7 years of experience.

Note on methodology

Sources: Pirical Legal Professionals, using publicly available data

Press releases from AM Law 1-25 firms that had announced Partner promotions at time of writing

(Kirkland & Ellis, Baker McKenzie, DLA Piper, Latham & Watkins, Skadden, Ropes & Gray, White & Case, Morgan Lewis, Simpson Thacher & Bartlett, Hogan Lovells, Goodwin Procter)

Written using publicly-available data from Pirical Legal Professionals (PLP)

Unlock unparalleled coverage of the legal market

Global attorney database built with the most comprehensive sources of data on the market. Designed for law firm lateral hiring teams, legal headhunters and strategy planners, our data tracks over 620,000 profiles across 130+ countries. PLP enables firms to source talent quicker, leverage their own network for referral opportunities, map out competitors’ org structures, research new markets and much more.

Subscribe to the latest data insights & blog updates

Fresh, original content for Law Firms and Legal Recruiters interested in data, diversity & inclusion, legal market insights, recruitment, and legal practice management.