Mapped: What Would the Alston & Bird and Cadwalader Merger Look Like?

Yesterday, the news broke that Alston & Bird and Cadwalader were in merger talks. The combination would create a law firm of around 1,400 attorneys and $2 billion of revenue.

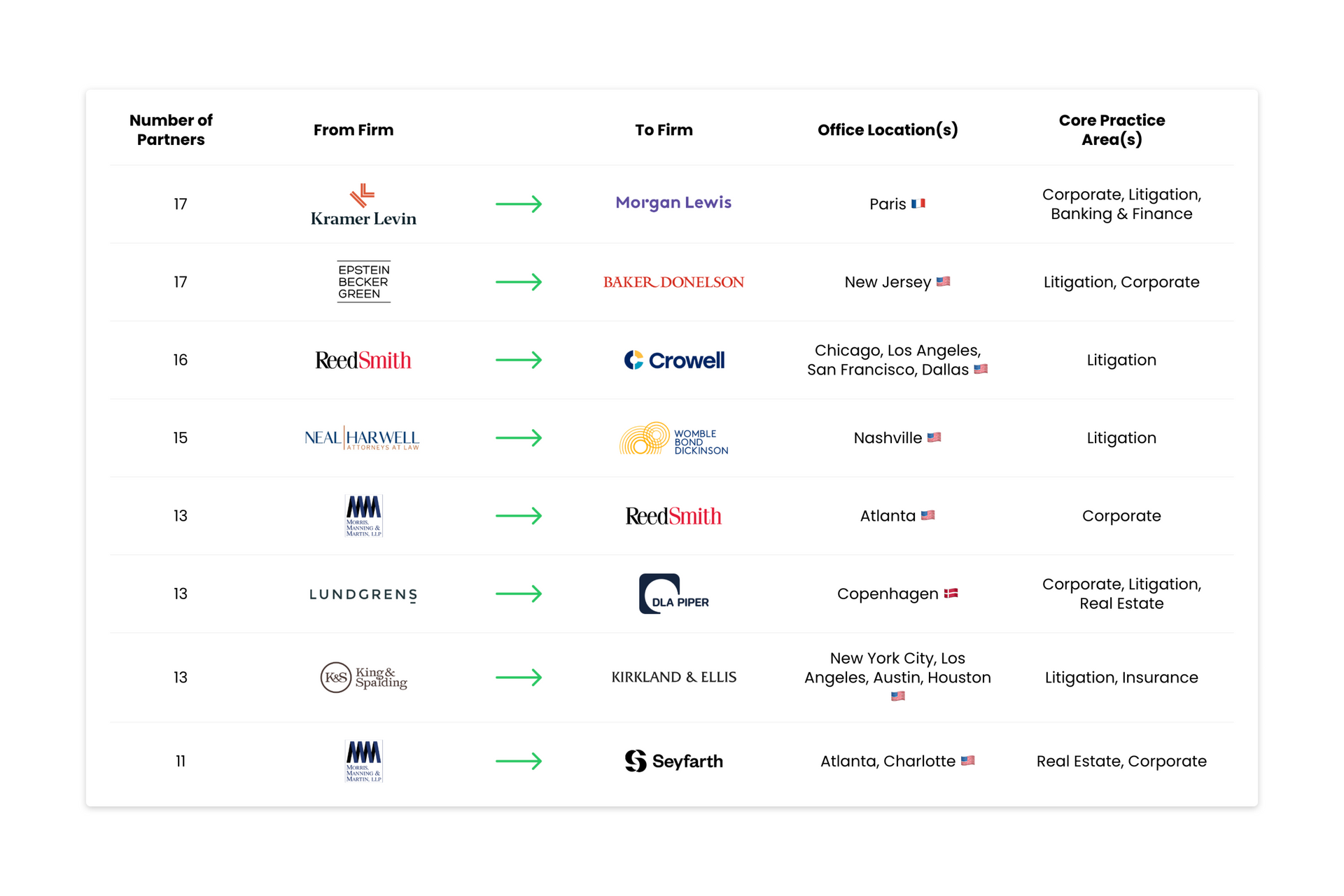

If it goes ahead, the merger would primarily bolster Alston & Bird's New York presence and Banking & Finance practices. This latest merger story, follows a wave of recent Big Law combinations like McDermott Will & Emery and Schulte Roth & Zabel, Herbert Smith Freehills & Kramer Levin and Troutman Pepper & Locke Lord.

Using publicly-available data tracked by

Pirical Legal Professionals (PLP), we've taken a look at which locations & practices would grow under the merger, and how many Partners can be expected to leave throughout the talks.

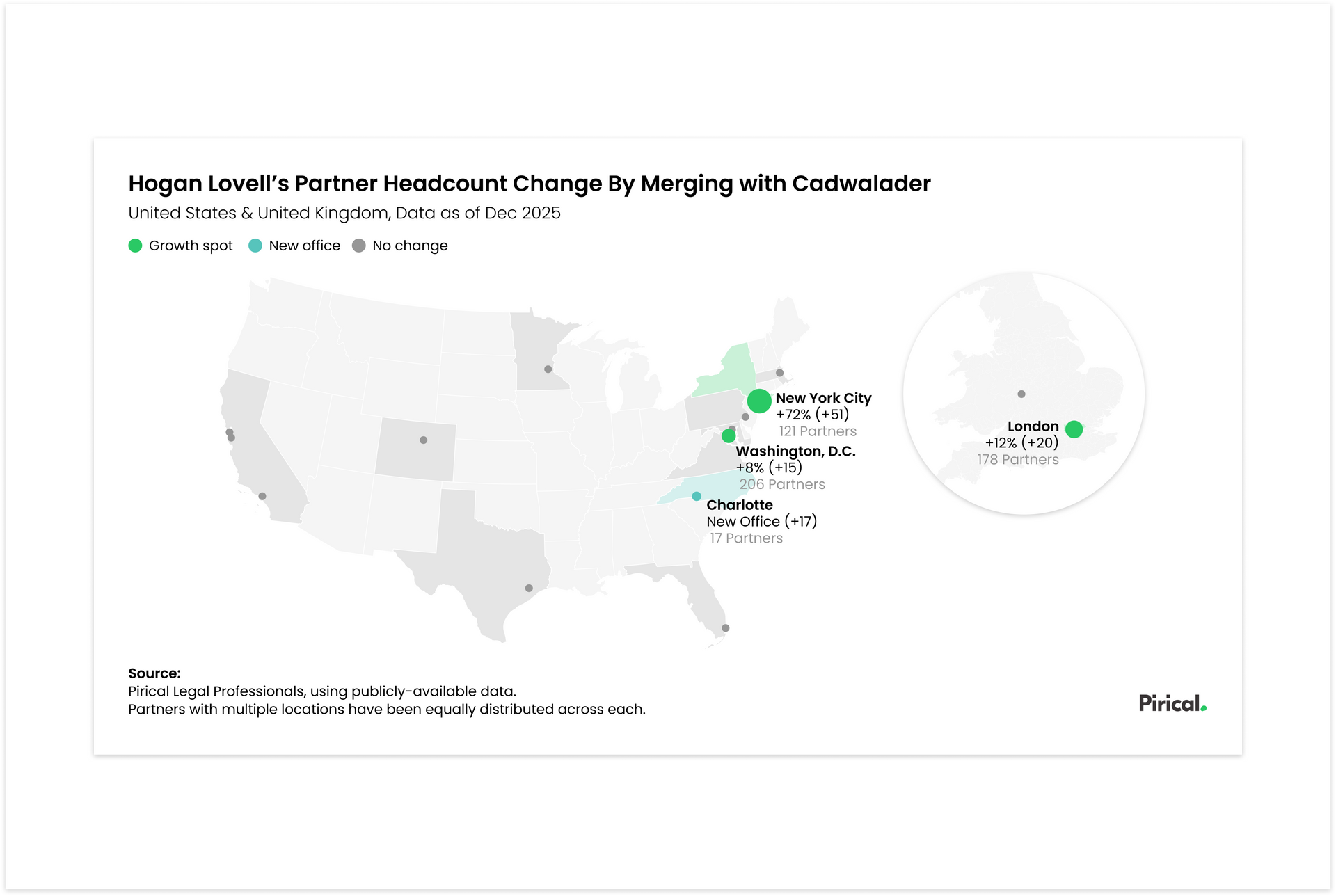

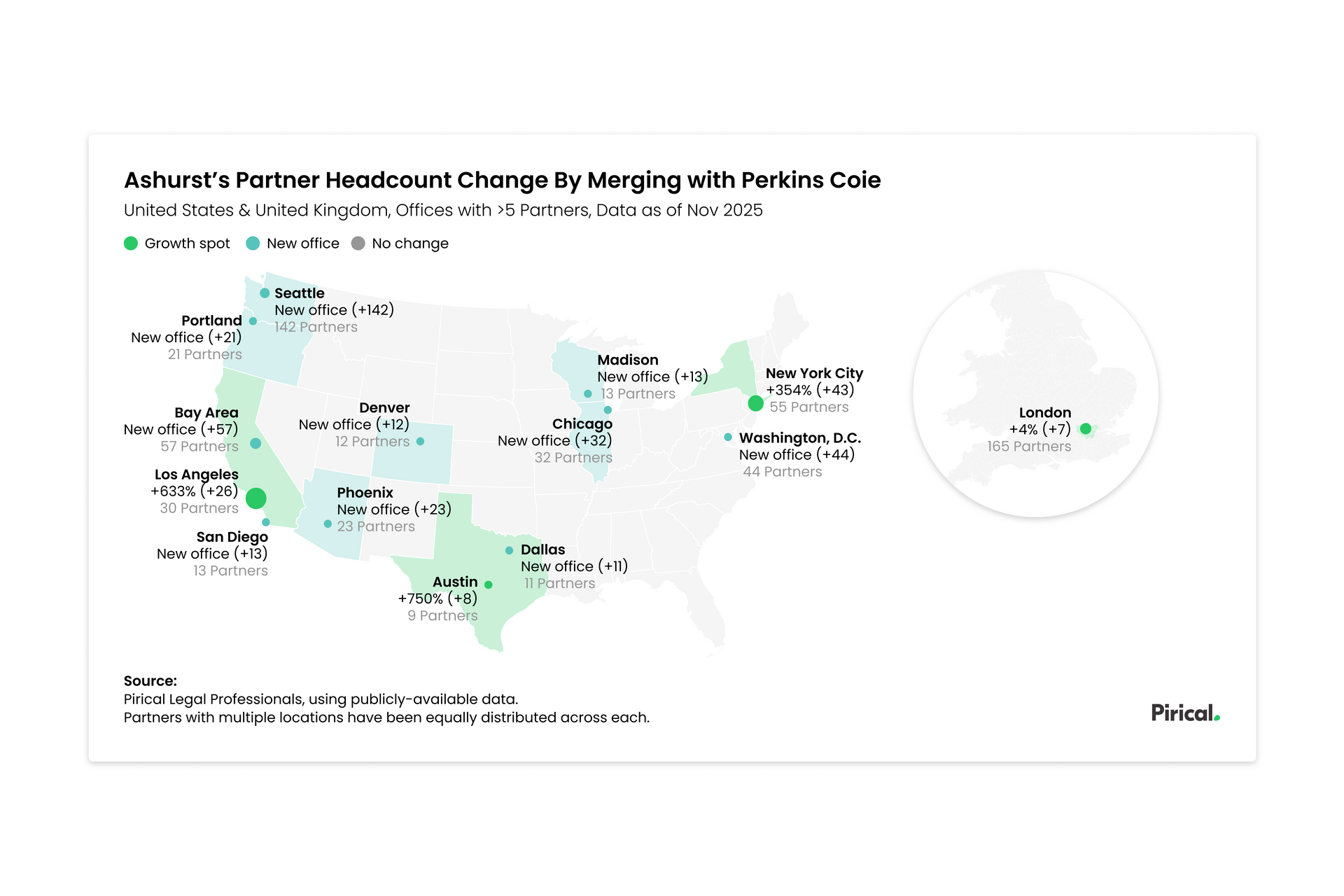

By Merging With Cadwalader, Alston & Bird Would Bolster Their Presence in New York City and Grow in London & Charlotte

Alston & Bird's Partner numbers in Washington, DC would also increase and Cadwalader's Dublin office represents a potential new location.

Cadwalader's Depth in Banking & Finance and Capital Markets Means Alston & Bird Would Expand in Those Practice Areas

Both Firms Could Expect to Lose a Small Number of Partners Between the Merger Announcement and Completion

Note on methodology

Source: publicly-available data tracked by Pirical Legal Professionals (PLP)

Notes: Based on all current Cadwalader Partners staying post-merger, attorneys with multiple locations have been equally distributed across each

Timeframe: Data as of November 2025

Analysis powered by Pirical Legal Professionals (PLP)

Pirical Legal Professionals is the largest attorney database built with the most comprehensive data on the market. Specifically designed for legal recruitment and legal market research.

Pirical seamlessly aggregates data from a wide range of public sources, tracking over 700,000 attorney profiles worldwide. Our data helps law firms source lateral talent quicker, identify candidates with key client relationships, map competitor firm strategies & team structures, and much more.

Subscribe to the latest data insights & blog updates

Fresh, original content for Law Firms and Legal Recruiters interested in data, diversity & inclusion, legal market insights, recruitment, and legal practice management.