Mapped: what would the Herbert Smith Freehills & Kramer Levin merger look like?

Earlier this week, Herbert Smith Freehills and Kramer Levin announced their plans to merge. The combination would create a law firm of around 2,700 lawyers and $2 billion of revenue. The Partner vote is due to take place in February 2025 and if approved, the merged firm would rank in the top 25 globally.

Using publicly-available data from Pirical Legal Professionals (PLP), we've taken a look at which locations & practices would grow under the merger and where Herbert Smith Freehills might sit relative to rival UK firms seeking to expand in the United States.

Herbert Smith Freehills will gain a stronger foothold in the US if the merger with Kramer Levin goes ahead

Both firms have similar levels of practice area depth and would strengthen shared practices such as Litigation, Corporate and Finance

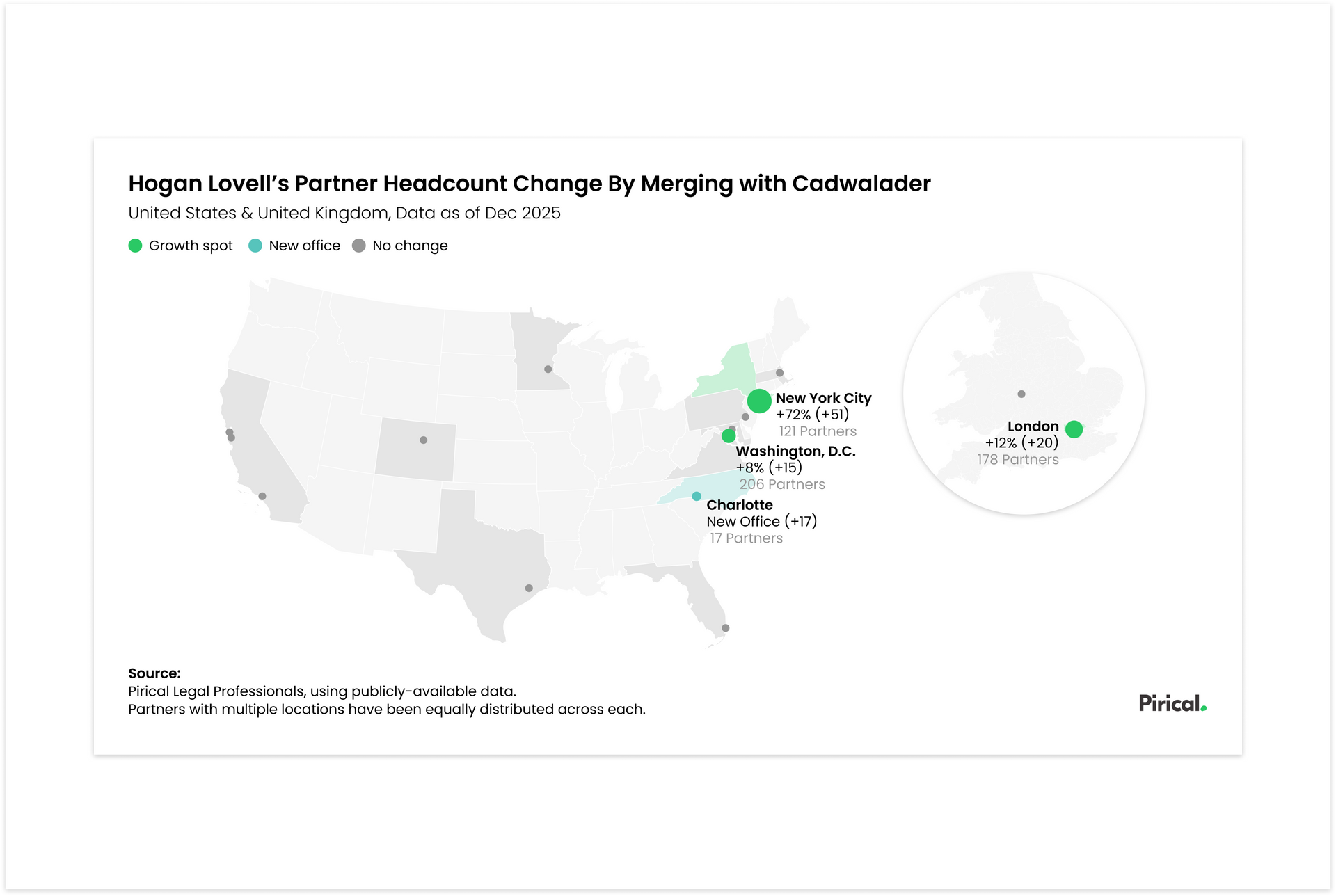

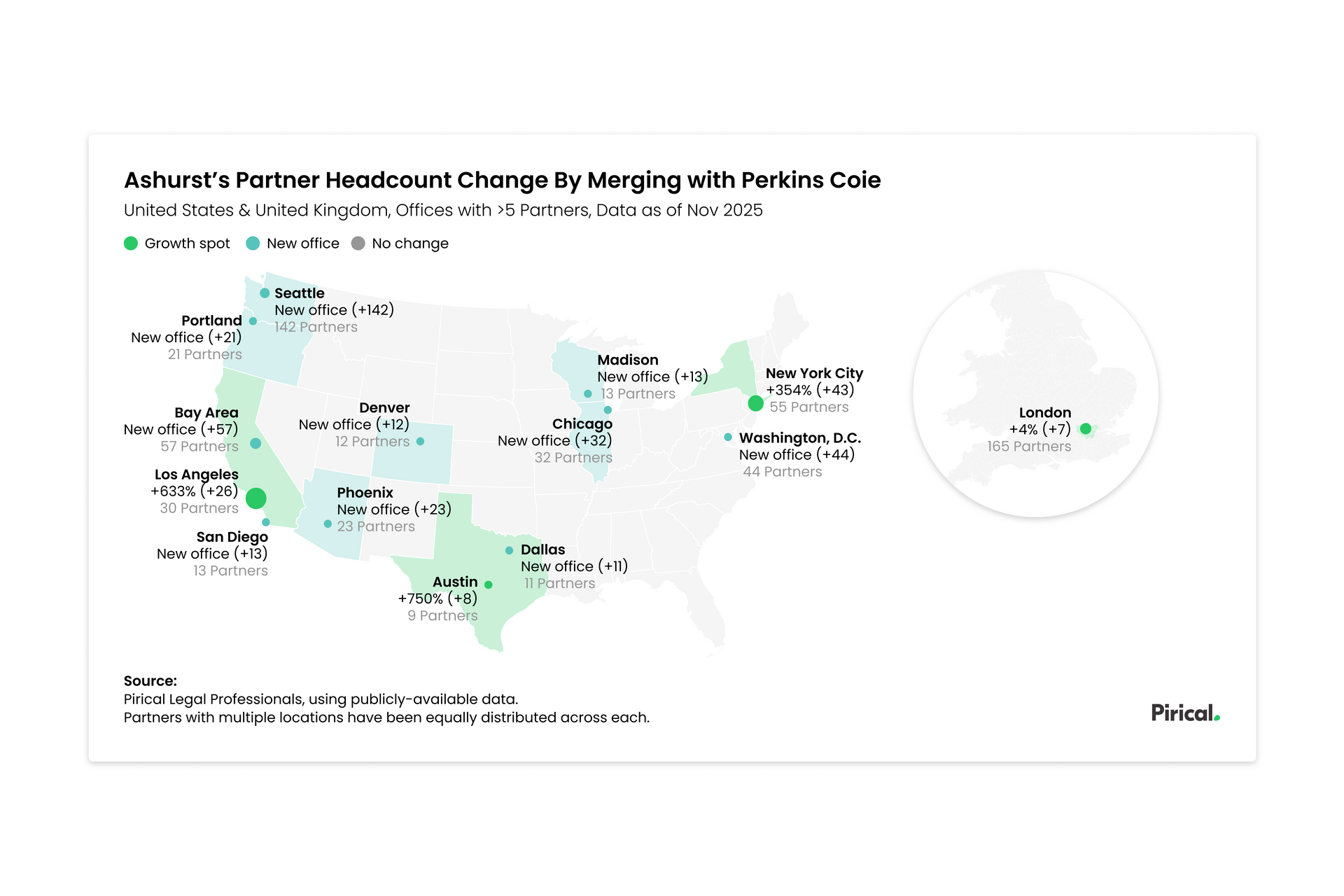

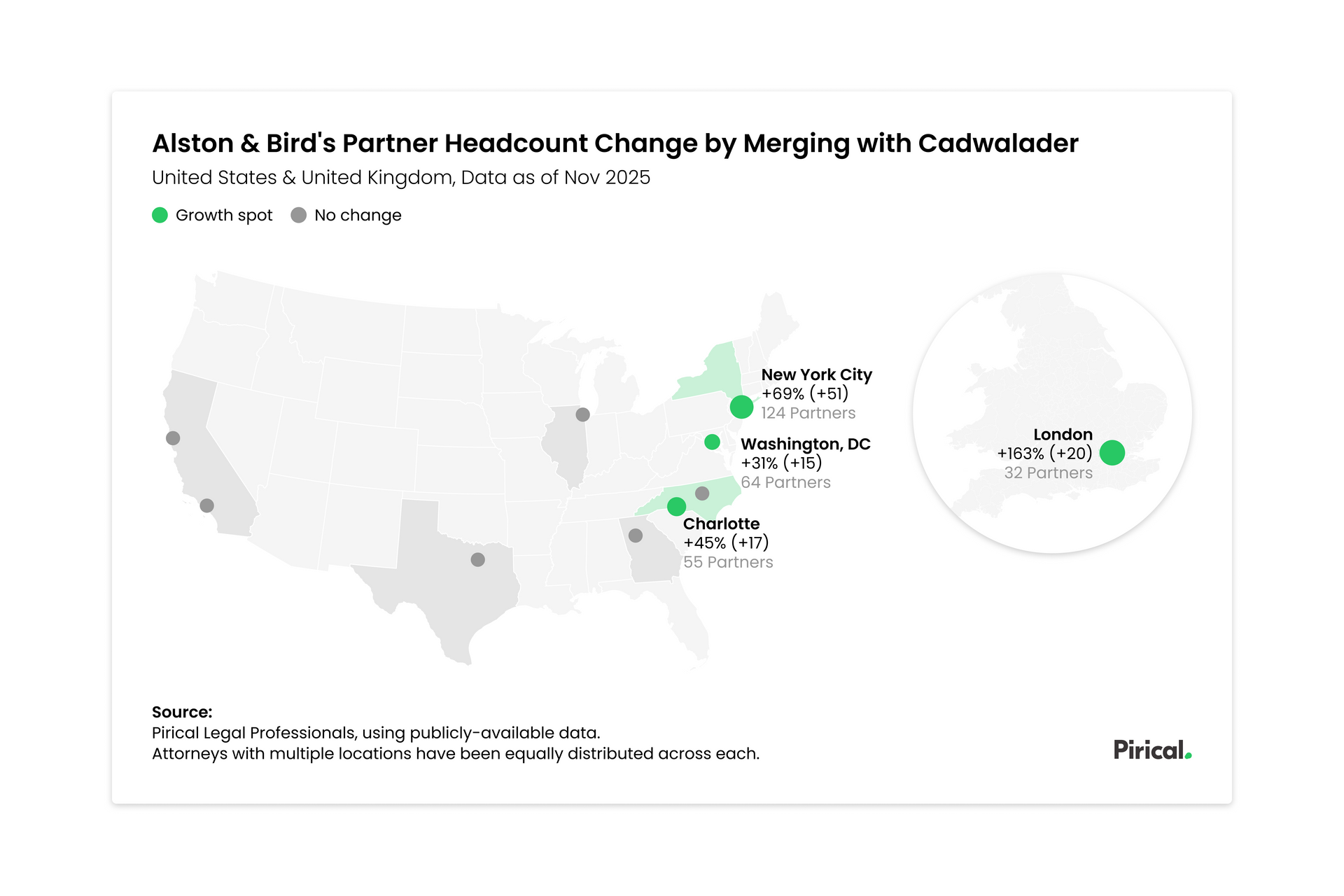

Herbert Smith Freehills could catch up with UK rivals in the US should the merger go ahead

Both firms can expect to lose a small number of Partners between now and the completion of the merger

Written using data from Pirical Legal Professionals (PLP)

Unlock unparalleled coverage of the legal market

Global attorney database built with the most comprehensive sources of data on the market. Designed for law firm lateral hiring teams, legal headhunters and strategy planners, our data tracks over 615,000 profiles across 130+ countries. PLP enables firms to source talent quicker, leverage their own network for referral opportunities, map out competitors’ org structures, research new markets and much more.

Subscribe to the latest data insights & blog updates

Fresh, original content for Law Firms and Legal Recruiters interested in data, diversity & inclusion, legal market insights, recruitment, and legal practice management.