Practice Growth Across the AM Law 200 (written for NALP Bulletin+)

We recently did some analysis for the NALP Bulletin+ magazine, looking at how practice demand has been shifting across the AM Law 200. Below is a copy of the article.

Many AM Law firms have seen demand for legal work increase over the past few years, but which practices have firms been focusing on? Using publicly-available data tracked by Pirical Legal Professionals (PLP), we’ve taken a look at some of the key practice growth trends among the Am Law 200 over the last three years.

Which Practice Groups Have Been Growing the Fastest?

Across the AM Law 200 globally, Partner headcount in Cybersecurity, Privacy & Data Protection has risen by +19% between 2022-2025, making it the overall fastest growing practice group. Regulatory & Compliance ranks 2nd with a +15% increase.

As the legal landscape around cybersecurity and data protection has become more complex in recent years, the demand for tech-literate legal professionals has clearly soared. Companies now have to “navigate a maze of new, and often overlapping, cybersecurity requirements” as well as heightened security standards.

Which Markets Have Been Growing the Fastest?

Factoring in specific geographic markets, we can track the fastest-growing individual practices across the AM Law 200 over the last 3 years.

Looking at the largest practices, with more than 100 combined Partners, the strongest growth has been in

Investment Funds in

London (+47%),

Washington, DC (+33%) and

New York City (+29%). As reported by

McKinsey, law firms responded by scaling up their Investment Funds teams to meet renewed demand for fund formation, structuring, and regulatory guidance.

Among smaller practices, with less than 100 combined Partners, the highest increases in headcount have been Litigation practices in emerging markets like Denver and Nashville. In fact,

Nashville has seen significant headcount growth in a variety of practices since 2022,

Real Estate (+75%), M&A (+69%), Employment Litigation (+68%) and

General Litigation (+61%). In February 2025, McDermott Will & Emery opened a Nashville office, reinforcing the city’s continued appeal to Big Law.

Looking at the AM Law 200 as a whole reveals some interesting trends, but to dig a little deeper we’ve also broken it down by AM Law grouping.

Highest Growth Practices By AM Law Group

AM Law 1-50

The most significant growth among the top 50 firms has been concentrated in New York City and London, particularly within Finance related practices.

The individual practice with the highest growth is

London - Banking & Finance - Acquisition & Leveraged Finance (+75%), primarily driven by Kirkland & Ellis, Latham & Watkins, and White & Case adding Partners. The AM Law 50 has increased London-based Partner headcount by

+16% in the last 3 years and shows little sign of slowing down.

AM Law 51-100

In contrast to the top 50, firms ranked 51-100 have grown headcount in a wider variety of markets and practices, but M&A ranks highly in Denver (+94%), Boston (+66%), Houston (+50%) and Los Angeles (+44%).

Denver - Corporate - M&A has the strongest increase in headcount, partly influenced by Taft’s recent merger with the Denver law firm Sherman & Howard.

AM Law 101-200

The highest ares of growth for the AM Law second hundred have been more Litigation heavy than the top 100.

Partner headcount within Employment Litigation practices on the West Coast increased significantly, alongside General Litigation practices across the USA. The major +135% spike in San Diego is partly due to Quarles & Brady’s merger with the California-based labor and employment boutique firm, Paul, Plevin.

Which Markets Have Been In Decline?

Across the AM Law 200 a few practices have seen significant drops in Partner headcount since 2022. M&A in Detroit (-26%), as well as Insurance Litigation (-26%) and IP Litigation (-20%) in the Bay Area are some of the highest drop offs. However, a key broader trend has been the sharp fall in lawyers in China-based practices.

Formerly key practices such as M&A, Capital Markets, and Litigation have lost more than 220 AM Law Partners since April 2022. This combined decline in headcount has occurred in Beijing (-75%) and across China's key financial hubs, Shanghai (-72%) and Hong Kong (-20%).

With a decrease of over

100 Partners across the 3 cities, M&A practices have contracted the sharpest. The drop off reflects a broader pullback by US law firms from the Chinese market in recent years.

Reproduced from NALP Bulletin+. ©2025 National Association for Law Placement, Inc. (NALP). All rights reserved.

For reprint permission, please contact the NALP office at 202-835-1001 or email info@nalp.org.

Written using publicly-available data from Pirical Legal Professionals (PLP)

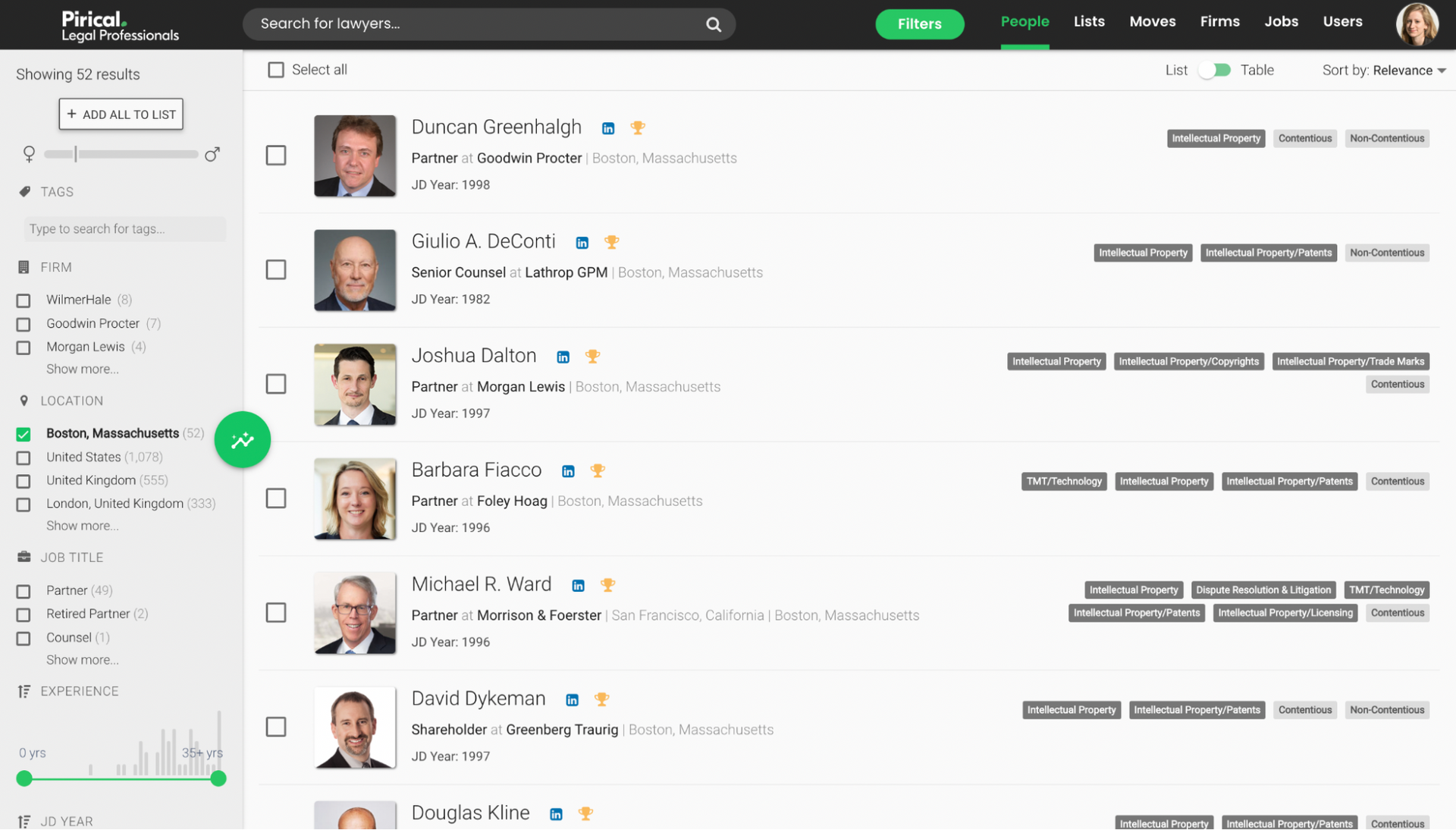

Unlock unparalleled coverage of the legal market

Global attorney database built with the most comprehensive sources of data on the market. Designed for law firm lateral hiring teams, legal headhunters and strategy planners, our data tracks over 690,000 profiles across 130+ countries. PLP enables firms to source talent quicker, leverage their own network for referral opportunities, map out competitors’ org structures, research new markets and much more.

Subscribe to the latest data insights & blog updates

Fresh, original content for Law Firms and Legal Recruiters interested in data, diversity & inclusion, legal market insights, recruitment, and legal practice management.