Inside the Numbers: The UK Legal Market in 2025

London dominates much of the UK's legal landscape but other legal hubs play a significant role and some are even growing at a faster rate. We've taken a closer look at the current distribution of the UK's top lawyers, which markets have been growing the fastest, and how large a presence US firms now have in the UK.

Using publicly-available data tracked by

Pirical Legal Professionals (PLP), here's a snapshot of the UK legal market in 2025.

Where Are the UK's Top Lawyers Located?

Among lawyers working at firms in The Lawyer UK 100, 94% are based in England, followed by Scotland with 5%, while the remaining share is split between Wales and Northern Ireland.

As expected, London dominates the legal landscape and accounts for 56% of The Lawyer UK 100 lawyers, with

22,225 calling it home. The next largest city is Manchester, with just over

2,700 lawyers, nearly a tenth the size of London, followed by Bristol (2.1k) and Birmingham (1.9k).

These numbers highlight London’s overwhelming scale compared to other regional centres, and its distinct appeal to the largest British law firms as well as global firms.

London May Have the Largest Headcount but Which UK Cities are Growing the Fastest?

Over the last 3 years, the cities with the largest Lawyer UK 100 populations have experienced varied levels of growth. Manchester (+32%), Exeter (+32%) and Bristol (+31%) have increased lawyer headcount the most. These three cities have grown faster than London (+20%) over the same period.

"Powered by a varied economy, strategic location, excellent transport links, and a comparatively lower cost of living", Manchester has experienced strong legal sector growth in recent years. Manchester offers a wide range of potential clients to firms looking to grow, partly due to the city's role as "the UK’s foremost tech hub outside of London."

Bristol's rapid rise could be due to its growing status as a cost-effective alternative to London, attracting lawyers to move there and firms to open new offices, establishing the city as a key legal hub outside of the capital.

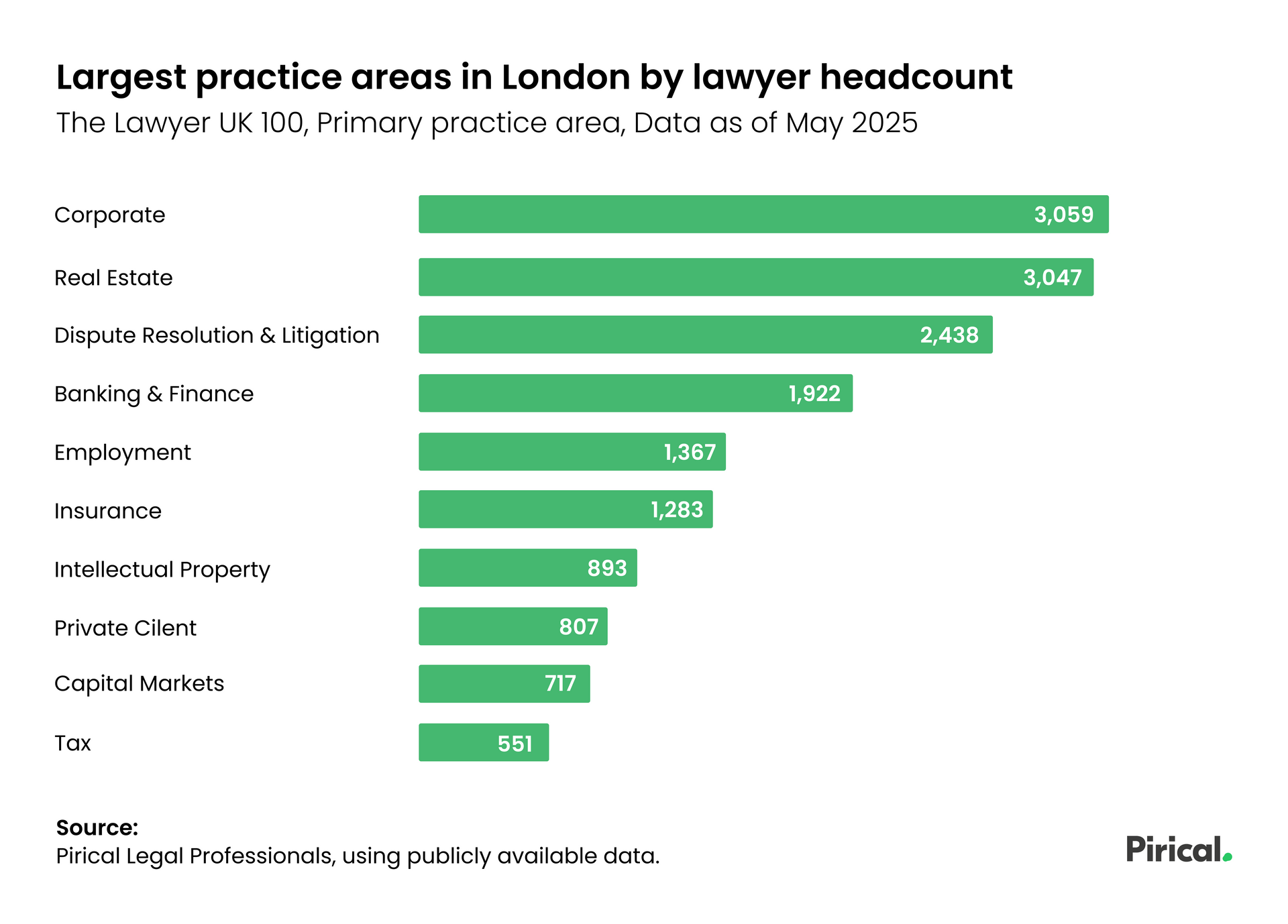

What Are the Largest Legal Practices in London?

Corporate remains the largest primary practice area among The Lawyer UK 100 firms in London, with 3,059 lawyers primarily focused on Corporate work, a 27% increase since 2022. This growth is likely driven by sustained M&A activity, which continues to fuel strong demand for specialist Corporate lawyers in 2025.

Real Estate holds the second-largest headcount with

3,047 lawyers and has grown by

14%,

while

Dispute Resolution & Litigation has increased by

17% to

2,438 lawyers. Banking & Finance (1,992) and Employment (1,367) round out the top five largest practices in London.

What Are the Fastest-Growing Practices in the UK?

The fastest-growing legal practices among Lawyer UK 100 firms, again highlight Manchester and Bristol as key legal hubs on the rise.

Manchester-based practices that have seen lawyer headcount increase the most are Private Client (+55%), driven by several law firms including JMW and Irwin Mitchell, Employment (+29%), from the likes of Lewis Silkin and Hill Dickinson, and Insurance (+27%), with DWF and Clyde & Co growing the most.

While in Bristol, Corporate (+42%) and Dispute Resolution & Litigation (+39%) have grown thanks to firms such as Burges Salmon and TLT.

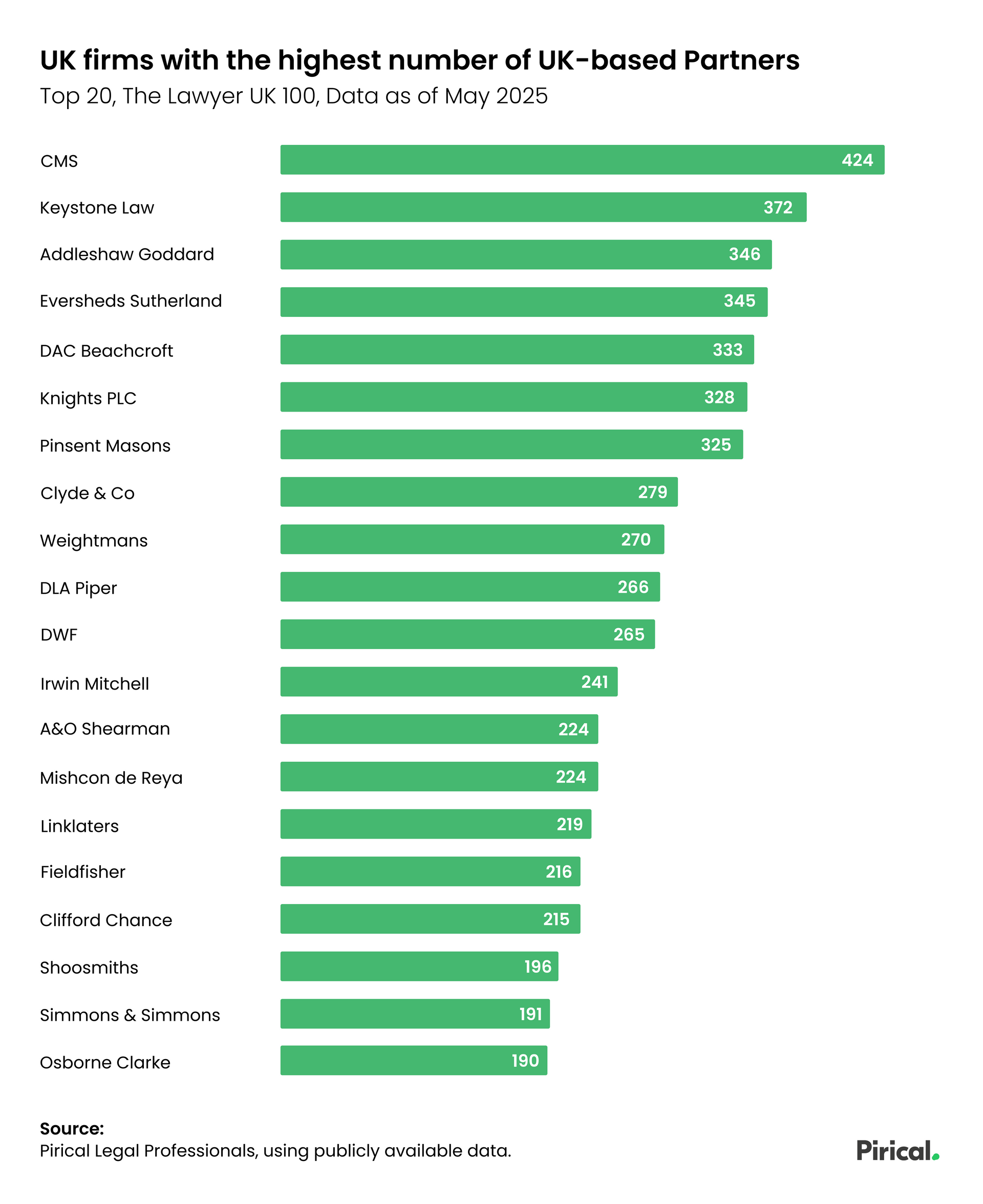

The Largest Law Firms in the UK by Partner Headcount

UK Headquartered Firms

Firms within The Lawyer UK 100 have increased UK-based Partner headcount by +14% since 2022.

In terms of total Partners, CMS leads the way with 424, followed by Keystone Law (372) and Addleshaw Goddard (346). Knights PLC has now entered the top six, promoting nearly 30 new Partners in its latest round, bringing its total to 328.

In contrast, the Magic Circle firms operate with smaller Partnerships, collectively employing just under

950 Partners in the UK. A&O Shearman currently have the most with

224 Partners, followed by Linklaters (219), Clifford Chance (215), Freshfields (161), and Slaughter and May (105).

"Partner recruitment in London remains extremely active. In particular, US firms continue to make headlines, with some fast-growing firms such as Paul Weiss needing to hire multiple Partners and other firms looking to achieve more dominance by building out their London bases.

Despite this, we have seen a slight reduction in immediate partnership hires this year. Among both US and UK-headquartered firms, there has been more of a focus on hiring gradually and based on specific requirements. Many firms are moving away from high volume hires and showing a real appetite to attract Partners who can make a strategic difference."

Amy Hambleton | Director, RedLaw Recruitment

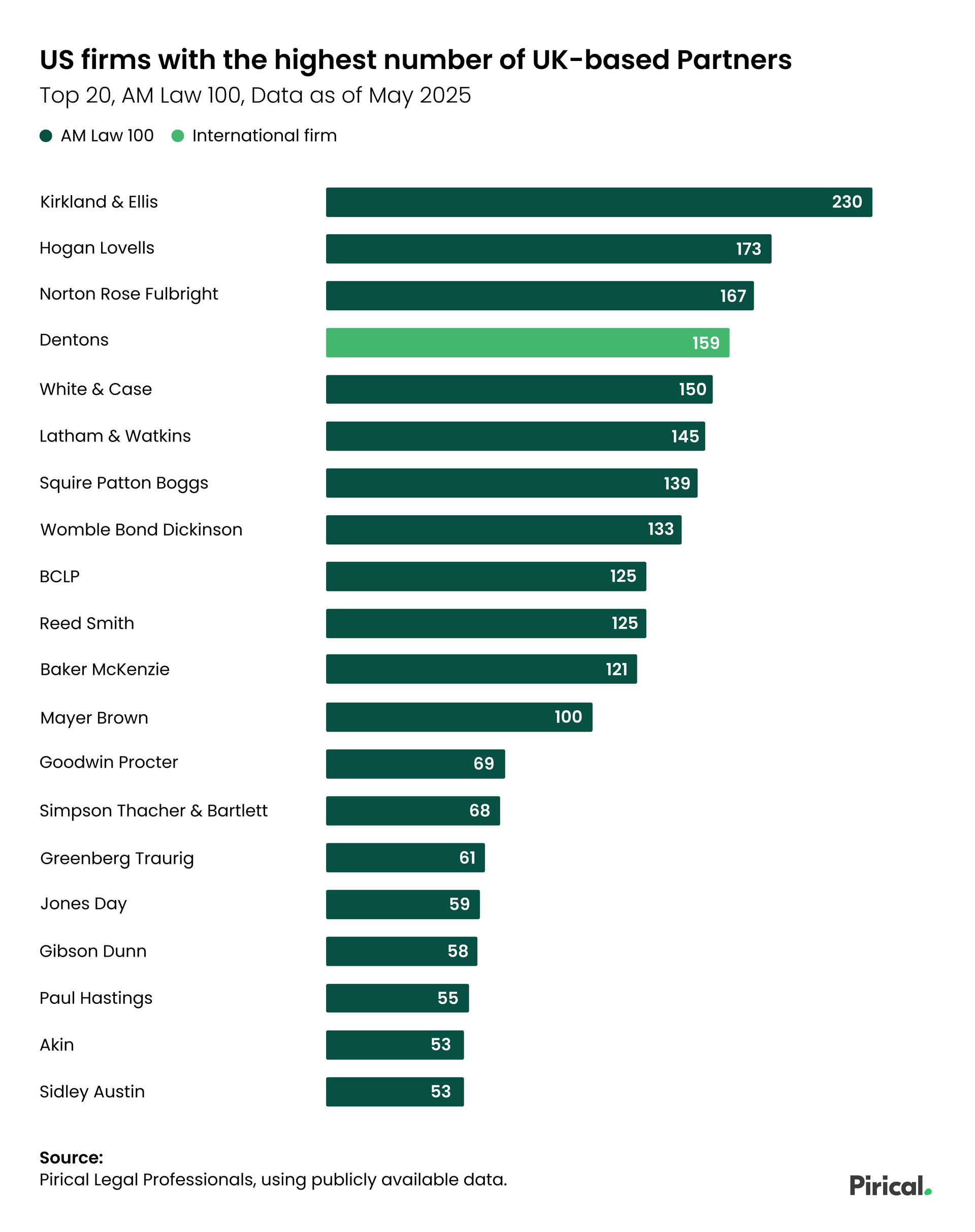

US Headquartered Firms

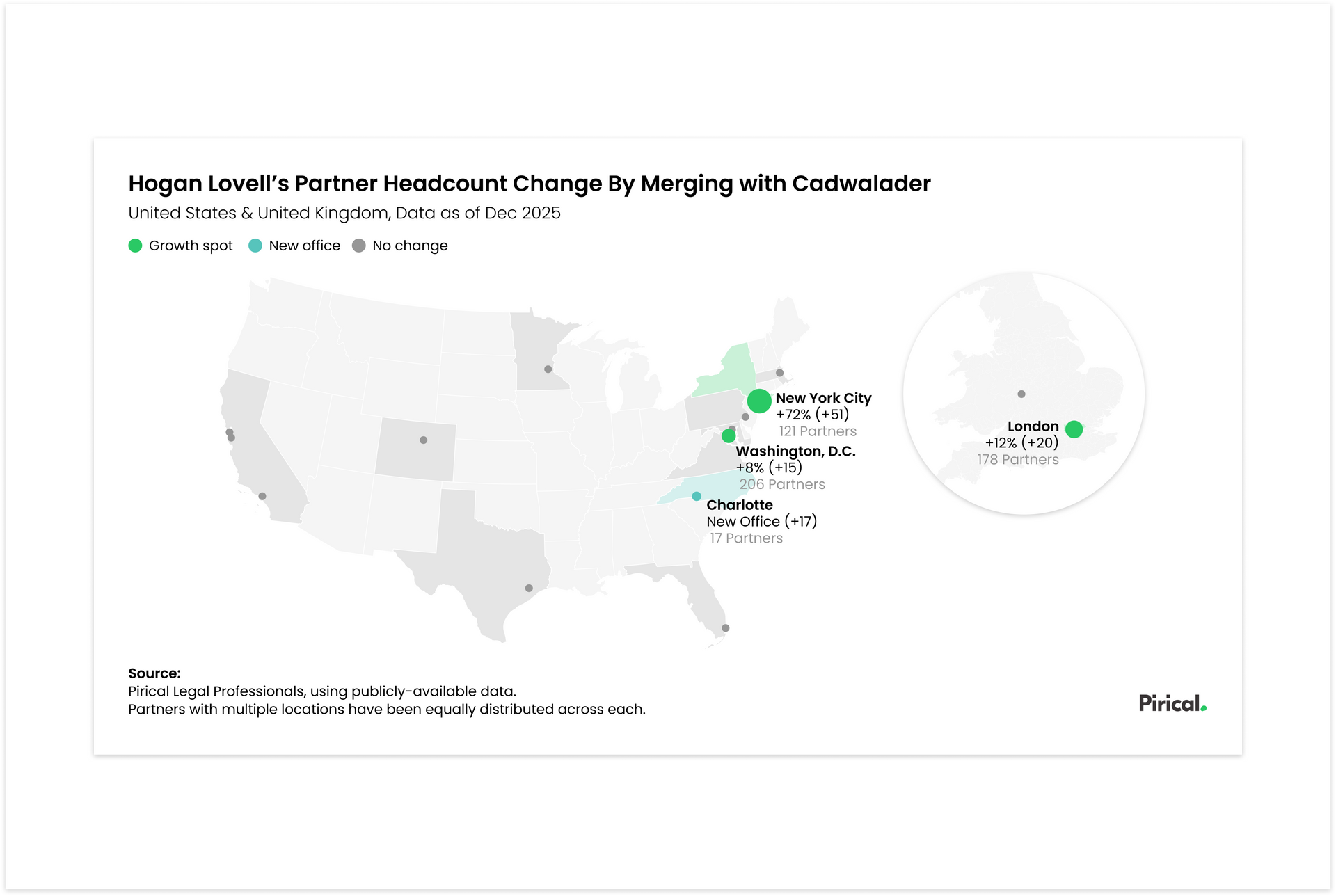

London has become a key area of growth for US firms in recent years, with AM Law 100 Partner headcount growing by +22% since 2022.

Kirkland & Ellis, in particular, has built up one of the largest UK-based partnerships of any non-UK firm, with

230 Partners, surpassing even some of the UK's biggest domestic players. Hogan Lovells (173), Norton Rose Fulbright (167), Dentons (159), and White & Case (150) aren't far behind, all maintaining large teams that signal a long-term investment in the UK market.

Written using publicly-available data from Pirical Legal Professionals (PLP)

Unlock unparalleled coverage of the legal market

Global attorney database built with the most comprehensive sources of data on the market. Designed for law firm lateral hiring teams, legal headhunters and strategy planners, our data tracks over 690,000 profiles across 130+ countries. PLP enables firms to source talent quicker, leverage their own network for referral opportunities, map out competitors’ org structures, research new markets and much more.

Subscribe to the latest data insights & blog updates

Fresh, original content for Law Firms and Legal Recruiters interested in data, diversity & inclusion, legal market insights, recruitment, and legal practice management.